Some companies pay hourly employees different rates for different tasks or circumstances. For example, a gardening supply store has an employee who is paid $15 an hour when operating heavy equipment and $12 an hour when performing other tasks (overtime and double overtime are calculated separately).

If you pay an employee different hourly rates, we'll show you how to enter the rates, and then how to enter the employee’s hours when you write paychecks. You can also adjust the base rate for calculating overtime and double overtime.

Setting up more than one hourly pay rate

When you first set up your payroll, we ask what hourly rates you pay each employee. If you need to add or update an employee's hourly rate after you set up your payroll:

- Go to the Employees tab.

- Click the employee's name.

- Scroll down to the Pay section and click Edit.

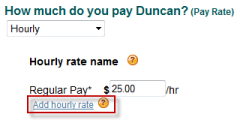

- Click Add hourly rate.

- Enter another rate.

You can add up to eight hourly rates for each employee. The first is always called Regular Pay on the employee's paycheck. When you add more rates, you can name them whatever you want.

Any name you add to an employee's hourly pay, such as Cash Register, will be available for all other hourly employees. You can pay all of the employees the same rate or different rates.

For example, a new employee working the cash register might earn $10.00/hour, while an experienced employee working the cash register earns $12.00/hour. You can apply the same hourly rate name to each employee, but enter a different hourly rate.

Paying an employee more than one hourly rate

Paying overtime and double overtime

Calculating sick pay, vacation pay, and overtime

Comments

0 comments

Article is closed for comments.