It's easy to delete an employee's most recent paycheck.

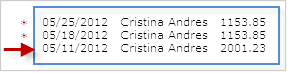

To delete an older paycheck, you'll also need to delete that employee's more recent paychecks. For example, to delete the 5/11/2012 paycheck below, you also need to delete the 5/25/2012 and 05/18/2012 paychecks.

Once you've deleted paychecks, you should recreate them in pay date order (earliest date all the way to the present).

Don't worry. When you recreate paychecks, our system automatically recalculates taxes and forms.

When you need to contact us

When you need to contact us:

There are some types of paychecks you can't delete yourself. Please contact us for help deleting any of these types of paychecks:

- A direct deposit paycheck after the money has been transferred. What time is money transferred? After we delete the paycheck for you, you'll need to collect the net pay from the employee.

- An adjustment check (adjustment checks are typically created automatically when a tax rate changes).

- A paycheck that included an Intego workers' compensation payment. (You can delete paychecks with other types of workers' compensation payments.)

After you contact us and you're ready to recreate paychecks, you'll need to use the create 2nd check link on the employee's row on the Create Paychecks page to recreate paychecks we deleted for you. Then fill out the Create Paycheck window and click Create.

If you need to delete far back

If you need to delete far back:

If you need to recreate a paycheck in a quarter for which a SUI tax payment was made (in any state except California), you'll need to delete that tax payment first, recreate the paycheck, and then recreate the SUI tax payment. If you paid the SUI tax payment electronically, though, you'll need to contact us to do this for you.

If you delete or recreate paychecks for a period in which tax payments have been made or forms have been filed, you may have additional tax payments due or credits owed. You may need to prepare and file amended tax forms. (In that case, you'll need to get help from your accountant; our payroll service doesn't support amended forms.)

Ready to get started?

To delete a paycheck:

- Choose Payday > Paycheck List.

- At the top of the page, choose a Range that includes all the paychecks you may have created since the oldest paycheck you want to delete.

- Why is this important? If you created paychecks out of order, the default Range setting might not include them. Maybe it is January and you've been working on December paychecks.

- At the bottom of the list, click Show adjustment checks so you see all paychecks.

- In the Select column, mark the most recent paychecks you created, and click Delete. Click OK to confirm.

- If you get a red message at the top of the screen saying that you need to first delete checks marked with an asterisk, select those paychecks instead and click Delete.

- What if I get the red message, but I don't see any asterisks?

- Look for a small red asterisk in the Select column, like this:

If you don't see an asterisk, try enlarging the Range setting at the top of the list. Or, if you see a Show adjustment checks link at the bottom of the page, click it to show all checks. (If the links says Hide adjustment checks, you're already showing them.

If you don't see an asterisk, try enlarging the Range setting at the top of the list. Or, if you see a Show adjustment checks link at the bottom of the page, click it to show all checks. (If the links says Hide adjustment checks, you're already showing them. - After you delete paychecks, there is no confirmation message; they just disappear from the list.

To recreate each paycheck:

- Click the Payday tab.

- Set the original pay period, and select the box at the left of the employee's name.

- What if the pay period is so far back that it's no longer available to choose?

- Just use the earliest available pay period again, and click create 2nd check on the employee's row on the Create Paychecks page. Then fill out the Create Paycheck window and click Create.

- Create the paycheck as usual.

Comments

0 comments

Article is closed for comments.