- You'll need the following in advance:

- Email address

- FEIN

- ZIP code

- Business identification number (BIN) or account ID

- Letter ID - Located on any recent letter from the Oregon Department of Revenue.

- Go to https://revenueonline.dor.oregon.gov/tap/_/#11

- If you are confronted with the "Click Here to Start Over" button, select the "Click Here to Start Over" button

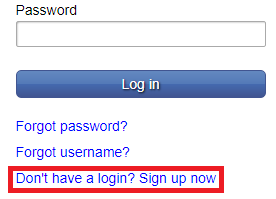

- Select the Don't have a login? Sign up now link

- On the "Instructions" page, select the "Next" button in the bottom right

- On the "Customer Validation" page:

- For the "Select your access type" dropdown, select "Business"

- For ID Type, select "Federal Employer Identification Number"

- For FEIN, input your business FEIN

- For Legal Business Name, input your business legal name

- For Country, select USA

- For ZIP, input your business legal mailing address zip code

- Select the "Next" button

- On the "Account Validation" page:

- For "Account Type" select "Withholding (Payroll)"

- For "Account ID Type" select "Business Identification Number"

- For "BIN" input your Oregon Business Identification Number (9 digits, enter any missing digits a zeros to the front)

- For "Provide one option for validation below"

- Select "Letter ID"

- Input Letter ID

- Select the "Next" button

- Continue through the remainder of the account sign-up process

- Send LudtPayroll a scan/picture/copy of the letter you obtained the "Letter ID" from.

- Login and enable third party access.

Comments

0 comments

Please sign in to leave a comment.