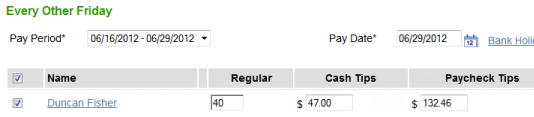

When you create a paycheck for an employee, enter the cash tips and/or paycheck tips along with other pay.

We report taxes for cash tips and include paycheck tips in the net pay. You can view your current tax liability as an employer at any time from the Tax Liability report.

Cash tips are not included in the gross pay, because employees have already received these earnings.

Comments

0 comments

Article is closed for comments.