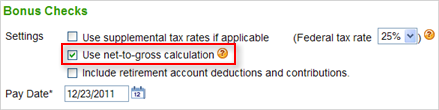

When you want to create a bonus check for a certain take-home (or net) amount, such as $100.00 or $500.00, you may want us to calculate the gross amount for you so taxes and deductions are calculated and included on the check.

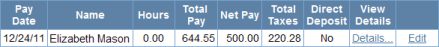

You tell us what you'd like the take-home bonus to be, and we'll figure out how much the check needs to be. For example, if you want to give your employee a take-home bonus of $500, we'll calculate the total amount of the check before taxes.

You can't use net-to-gross bonus calculation together with any deductions (retirement, HSA, or garnishments).

Important notes about net-to-gross

- You can't use net-to-gross bonus calculation together with any deductions (retirement, HSA, or garnishments).

- If the employee has any additional withholding deducted from each paycheck, it will be subtracted from the net pay during the net-to-gross calculation. To ensure that the net pay on the bonus check is the amount you expect, add the additional withholding to the amount in the Net Bonus field.

Example - To use the net-to-gross bonus calculation, you must pay bonuses separately from paychecks.

Comments

0 comments

Article is closed for comments.