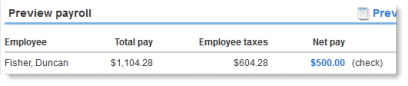

You tell us what you'd like the take-home bonus to be, and we'll figure out how much the check needs to be. For example, if you want to give your employee a take-home bonus of $500, we'll calculate the total amount of the check before taxes.

You can't use net-to-gross bonus calculation together with any deductions (retirement, HSA, or garnishments).

Important notes about net-to-gross

- You can't use net-to-gross bonus calculation together with any deductions (retirement, HSA, or garnishments).

- If the employee has any additional withholding deducted from each paycheck, it will be subtracted from the net pay during the net-to-gross calculation. To ensure that the net pay on the bonus check is the amount you expect, add the additional withholding to the amount in the Net Bonus field.

-

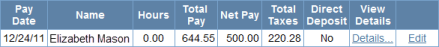

Let's say you want to give your employee a $500.00 bonus check, but the employee's profile is set up to withhold an additional $350.00 in federal taxes each paycheck.

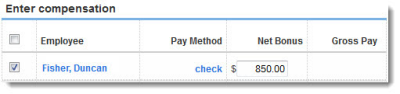

To ensure that the net pay on the bonus check is exactly $500.00, add the $350.00 to the amount in the Net Bonus field, like this:

and we'll calculate the correct amount on the check, like this:

- To use the net-to-gross bonus calculation, you must pay bonuses separately from paychecks.

Comments

0 comments

Article is closed for comments.